Payroll giving is a great tax- effective way to give regularly through your pay and really helps charities like us to plan and develop our vital services and support.

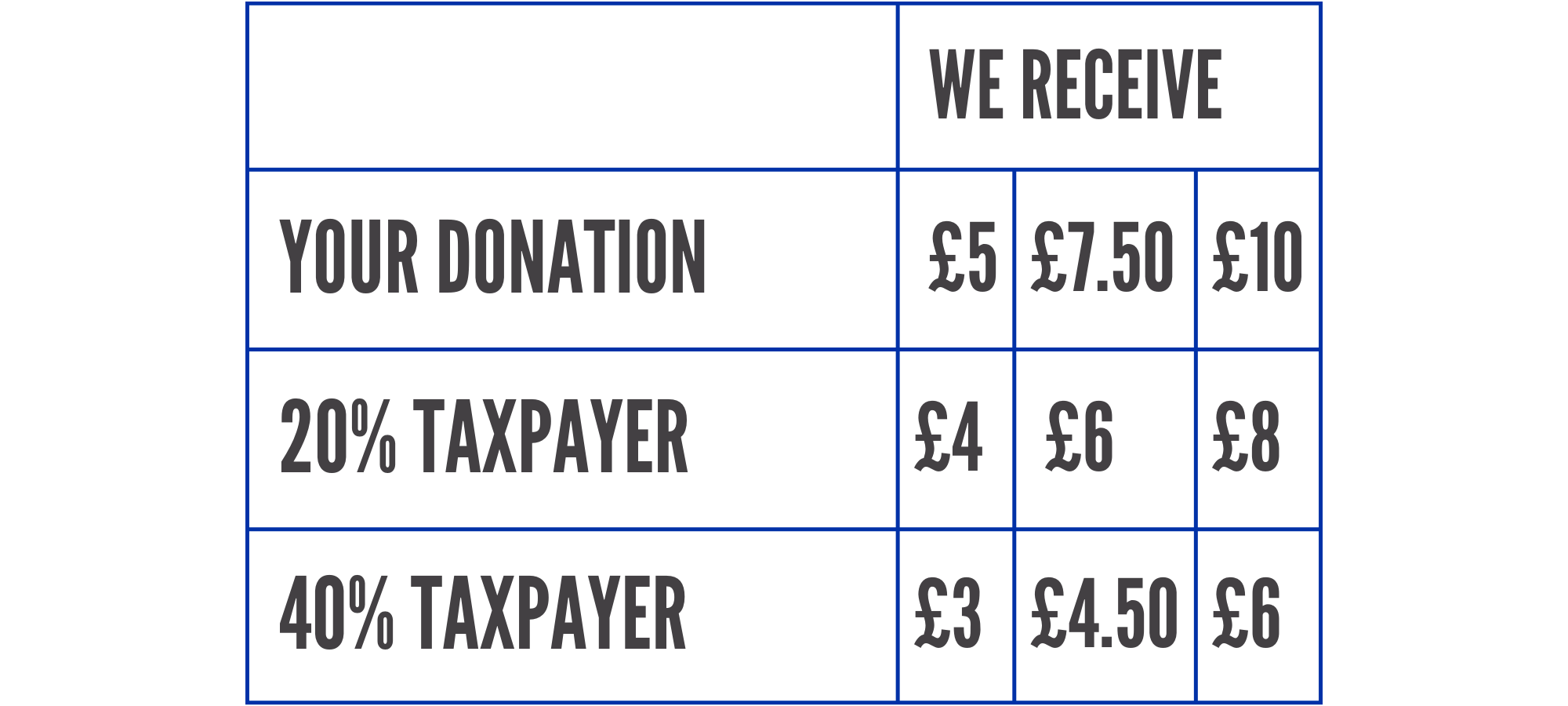

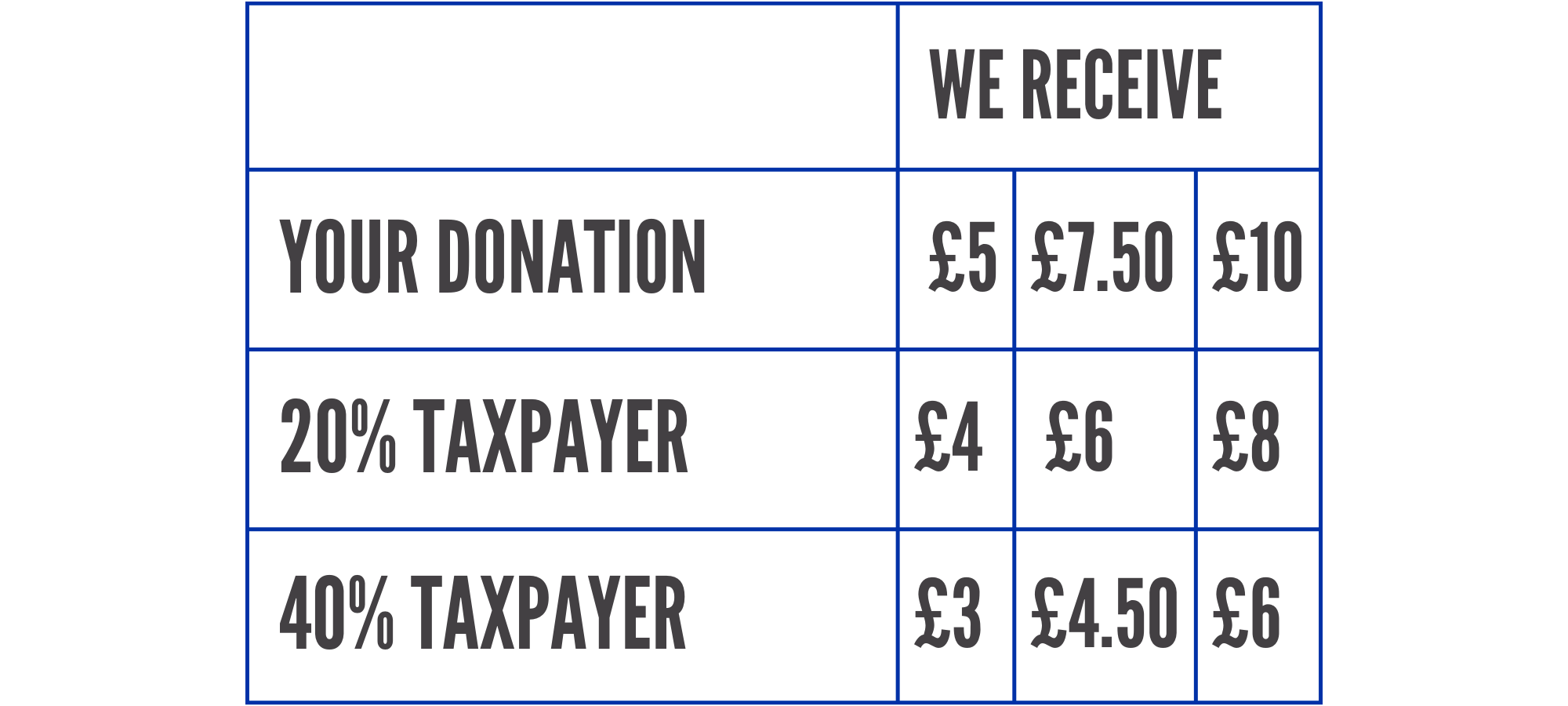

Your chosen regular amount is sent to us directly from your employer before it is taxed. Meaning a donation of £10 to The Connection could cost you as little as £6 (check out the table to below to find work out your cost).

Employee benefits:

It’s a tax efficient, so no need to sign up for Gift Aid.

It costs less to give more! – Your regular donation of £100 to us could cost you only £60.

It provides charities with a regular income, meaning we can plan ahead to develop our vital services and support.

It’s secure – you won’t need to disclose any bank details as there are no direct debits or standing orders to set up

Sign up today via our partner Sharing the Caring

If you choose to donate to us you will receive regular updates on how your donation is making an impact. You will also have the opportunity to have a tour of our centre to see first- hand the changes we are making.

Employer benefits:

Promoting giving via your pay could enhance your Corporate Social Responsibility activity, including donation matching.

It’s simple and easy to set up and can easily slot into the payroll routine. Most systems are already set up for it and most of the work is done by the HM Revenue and Customs regulated payment agency.

The costs are minimal

If you haven’t already, register with a payroll giving agency to set up a scheme today! They will be able to offer assistance and advice, answering any questions you may have about Payroll Giving too. Visit the HM Revenue and Customs site for more information

You can also promote your payroll giving scheme to staff by getting in touch with a Professional Fundraising Organisation (PFO) and arranging a visit from them, or maybe run this yourself via your Corporate Social Responsibility team.

Start giving here.